Poker Staking Essentials

One of the great ‘through the looking glass’ moments for any poker player is when they learn how much stakingStaking

When one player provides funds for another player to play in poker games, typically with an agreement to split profit at a predetermined percentage between the staker and the player. is involved in the poker ecosystem. When first introduced to the game, we assume that everyone playing in the $10,000 World Series of Poker Main Event is sufficiently bankrolled to do it on their own dime. It fits with the image—painted by movies like James Bond Casino RoyaleIt’s true that 007 himself was staked by the HM Treasury and the CIA, but unlike the others in the lineup, we don’t consider him a professional gambler.—that every professional gambler is a ‘high roller.’

The reality is that the vast majority of poker players in any given tournament have either been staked to play in it (known as being a “horse”), sold off a significant share of their action (to people known as “backers”), or at least made a “swap” for some percentage with their peers.

We are currently seeing record numbers in live poker, which produces seven-figure first prizes more frequently. All of which is propped up by the staking economy. When we see somebody take down a World Poker Tour or EPT title, we assume they are set for life and ready to ride off into the sunset with their newly acquired wealth. The reality is they rarely take home the advertised first prize when there are backers involved who take their cut. Indeed, things like the all-time money list, which is already broken due to it not showing profit, only turnover, do not tell the complete story when you factor in staking.

What follows is a guide to how the most common staking arrangements work.

Why Do People Need Staking?

When people learn about staking, their first question usually is, “Why would a good poker player need backing?”

There are a multitude of reasons.

- They simply don’t have the money. This could be because of life expenses—perhaps they just bought a house, for example, or have all their money tied up in investments. It might be because they went broke playing the game, which is obviously a red flag for any potential investor. It might also be because they went broke in other areas, like sports betting or crypto.

- Some may prefer having a third party handle money management for them. They might not like the pressure of doing it themselves and prefer the certainty that staking provides, like having a normal job. Or they may not trust themselves not to gamble with it. It’s a sad truth, but a lot of otherwise talented poker players end up going broke because they cannot be trusted with their own money.

- It comes with coaching. Many backers coach their horses. As well as stables that are structured like small businesses can have a coaching system built in.

- One of the main reasons poker players sell action is to reduce variance, especially when taking shots at bigger games. Much like how these players tend to make final table deals, when they are in a position where a lot of money is on the line, they want to mitigate bad variance by selling some of their action. This also happens when a player has already made the money. Sometimes, they sell some of their equity at a final table, which is a hybrid of staking and a final table deal.

Consider the case of a player who plays $1/$2 and wants to take a shot at $2/$4. Getting staked for that game on a 50/50 basis is quite pointless. They may as well play $1/$2 for 100% of themselves and will likely be in a softer game. However, sometimes the games at higher stakes yield a much better hourly. At the World Series of Poker (WSOP), for example, where some of the $1,500 games play close to how $20 online games play. A $20 grinder won’t be bankrolled for a $1,500 MTT, but they may be profitable in it, so getting staked makes sense for both backer and horse. Another similar but slightly different case is the one of a player who’s taking their first steps at a higher stake. They want to mitigate risk while they find their feet and learn about the population tendencies at the new level. - A final reason some players get backed, and this is a very new one, is a form of fan service. Many poker players fall into the ‘influencer’ category these days with a fanbase, and sometimes they sell action to their fans for fun. Daniel Negreanu, for example, does not need staking at the WSOP but sells a chunk of himself at zero markup every year, purely for his fans.

Where Do People Get Staking?

The staking scene is a thriving economy in poker, and this is why we see large numbers in tournament fields, both live and online.

Perhaps the most widespread single form of staking is when two players swap a percentage with each other. This usually takes place between friends who play mutual events, generally for something small like 5 or 10%. This also occurs sometimes later on in tournaments when two people are deep and have similar stack sizes, and the likelihood of one of them having a big score is much greater.

The next most common form of staking is when somebody sells pieces of themselves from a single tournament or package of tournaments, in a one-time arrangement on an open marketplace. This is what we will call a “markup deal,” for reasons that will be clear shortly.

This can be as informal as somebody offering a package on social media, and the whole thing is organized by private messages. It can also be on staking marketplaces like StakeKings, which is a peer-to-peer marketplace. In some instances, these marketplaces facilitate the transactions between the participants and shoulder some of the responsibility to pay out winners. They tend to charge a fee for their service.

Another recent innovation in staking comes in the form of a staking feature embedded in the poker site’s software. At the time of writing, you can buy into a tournament on GGPoker or ACR and sell action for it until it starts or before the start of day 2 in multi-flight tournaments. The backers use money from their poker room bankroll, and any winnings get automatically credited to the backer’s account again.

Another significant part of the staking economy is called a “makeup deal,” where players are backed for every game they play. The backer provides 100% of the money for the horse to play poker and, in many instances, also provides coaching. The split is usually 50/50.

Most horses with this kind of deal are one of many that the backer is staking, and they are collectively known as a “stable” who all utilize a shared bankroll. A lot of stables, though, are large businesses with full-time staff in charge of handling money transfers, coaching, and managing the players. Large stables like Team651 are like a poker subcommunity supporting their members through software, content, a place to network/collaborate, etc. Climbing the stakes with them is akin to climbing the corporate ladder.

Makeup Deals

A makeup deal is:

A deal where a backer provides a complete bankroll for a horse in return for a profit split, usually 50/50.

Scenario: Immediate Profit

If the backer buys the horse into a $1,000 MTT,

The horse ends up winning $3,000,

The backer gets their initial $1,000 back,

They both divide the net profit $2,000.

In case of a 50/50 split, each party profits $1,000.

This sounds ideal for the horse; they get to play for free, and the backer takes on all the risk. That’s not quite how it works though.

Because when the horse loses money on the stake, they go into what is called “makeup.” Their deal goes into a deficit and the losses need to be earned back before they can take any profit.

Scenario: Eventual Profit

Let’s imagine that I staked you, and:

You lost $1,000 on Monday,

$1,000 on Tuesday,

$1,000 on Wednesday,

On Thursday, however, you won $2,000 but would not get a cent of the win.

That is because you would still be down $1,000 on the stake overall, so every cent of the $2,000 win goes back to me, the backer. If you won another $2,000 on Friday, I would first recoup the remaining $1,000 deficit that I was owed. The remaining $1,000 of the Friday win would be split 50/50. So, you would end up with $500.

In the world of tournament poker, a horse can get into six or seven-figure makeup. It is not uncommon for a poker player to take down a large tournament, but the reality of their makeup situation is that they don’t have a cent to show for it.

In some hybrid-type deals, the backer allows the horse to take a “wage” from any scores that they have, to keep them motivated to play.

If you were $100,000 in makeup and had a $50,000 score,

The backer might take $40,000 of that,

Give you $10,000 for living expenses,

Your new makeup amount would be $60,000 (instead of $50,000).

Makeup deals can become troublesome for horses because they feel trapped in them. This is because these arrangements tend to involve some sort of contract, which states that the horse can only leave on certain conditions:

- The backer releases them

- The horse buys out of the contract

- The horse quits poker

Without such a contract, a horse could just go for a joyride with the backer’s bankroll and quit when their makeup becomes huge.

Of course, it is true that a player who loses $100,000 of their own money, rather than a backer’s, still needs to win six figures to ‘get even,’ but the reason why makeup deals can spiral out of control is also the reason why they appeal to many; you can move up the stakes quickly.

When someone plays $1/$2 independently and wants to take responsible shots at $2/$4, they need to build a bankroll first that can sustain the swings of those higher stakes. The same goes for $5/$10, and every next level. This takes time.

A backing deal, however, can be a bypass for this bankroll-building process. If a backer sees promise in you or knows of a bigger game you can beat, they can provide you with that bankroll, which enables you to parachute straight into those bigger games. This happens a lot in stables with an infrastructure of coaches, content, and software. It’s quite common, for example, in Spin & Go stables that some players will leapfrog the stakes, going from low to high quickly and skipping the middle altogether. This does entail a danger, however. A relatively low-stakes player can suddenly accumulate a high-stakes amount of makeup very quickly.

Risks

Makeup deals sound sweet at first, but they can turn sour quickly. Otherwise, very talented players in lots of makeup can lose motivation and sometimes quit the game entirely because the prospect of playing every day with no hope of turning a profit anytime soon is grim.

Rewards

They are perhaps the best option for poker players who need imposed structure in their lives. Whether they play better when it’s not their own money on the line, benefit from the coaching and community of the stable, or cannot trust themselves to make wise financial decisions, there are certainly many players who benefit from makeup deals.

Markup Deals

A markup deal is:

An isolated, one-time deal in which a piece (percentage) of someone’s action in a poker event, or series of events can be bought.

For example, if I play a $1,000 event and sell you 10% for $100, and I win $2,000. You will get $200 back.

One difference between a makeup deal and a markup deal is that in a markup deal, if you lose money, you have no obligation to pay back losses to a backer. Any future deals start with no makeup.

The only exception, of sorts, is that some horses offer diluted shares on reentries. So, in the example above, if I bust my first $1,000 bullet and rebuy, you do not get 10% of me because that was only on the first bullet. However, as part of that original deal, I may also give you 2% of my second bullet. This is optional and not the norm, and it is often done either as a gesture of goodwill or an incentive to buy the original piece.

In most cases, professional poker players apply a markup on the up for sale pieces of themselves. This is a premium that reflects their ability and effort. In the example I’ve been using, if I sell you 10% of my $1,000 MTT at a markup of 1.2, that means it costs you $120 to buy, not the $100 face value cost. If I go on to win $2,000, you still only get $200 back, and I am an additional $20 better off because of the markup.

- 1k MTT with a 10% piece for sale

- Markup 1.2

- Cost price = 120 instead of 100 (face value)

By applying a markup on a package, the horse is essentially declaring they are a winning player.

In most cases, the markup reflects what the player feels their ROIReturn On Investment (ROI)

The aggregate money won, divided by tournament entry fees. If you have paid $1000 in entry fees, and won $2000 total, your return on investment (ROI) is 200%. is. So, if a player sells at 1.2, they are suggesting that they have a 20% ROI in the tournament they’re selling action for. This is near impossible to quantify and should also vary from tournament to tournament. Most players charge their highest markup in the WSOP Main Event, which is notoriously soft, but they should not charge anywhere near as much for, say, a $25,000 high roller, where everyone’s edge is lower.

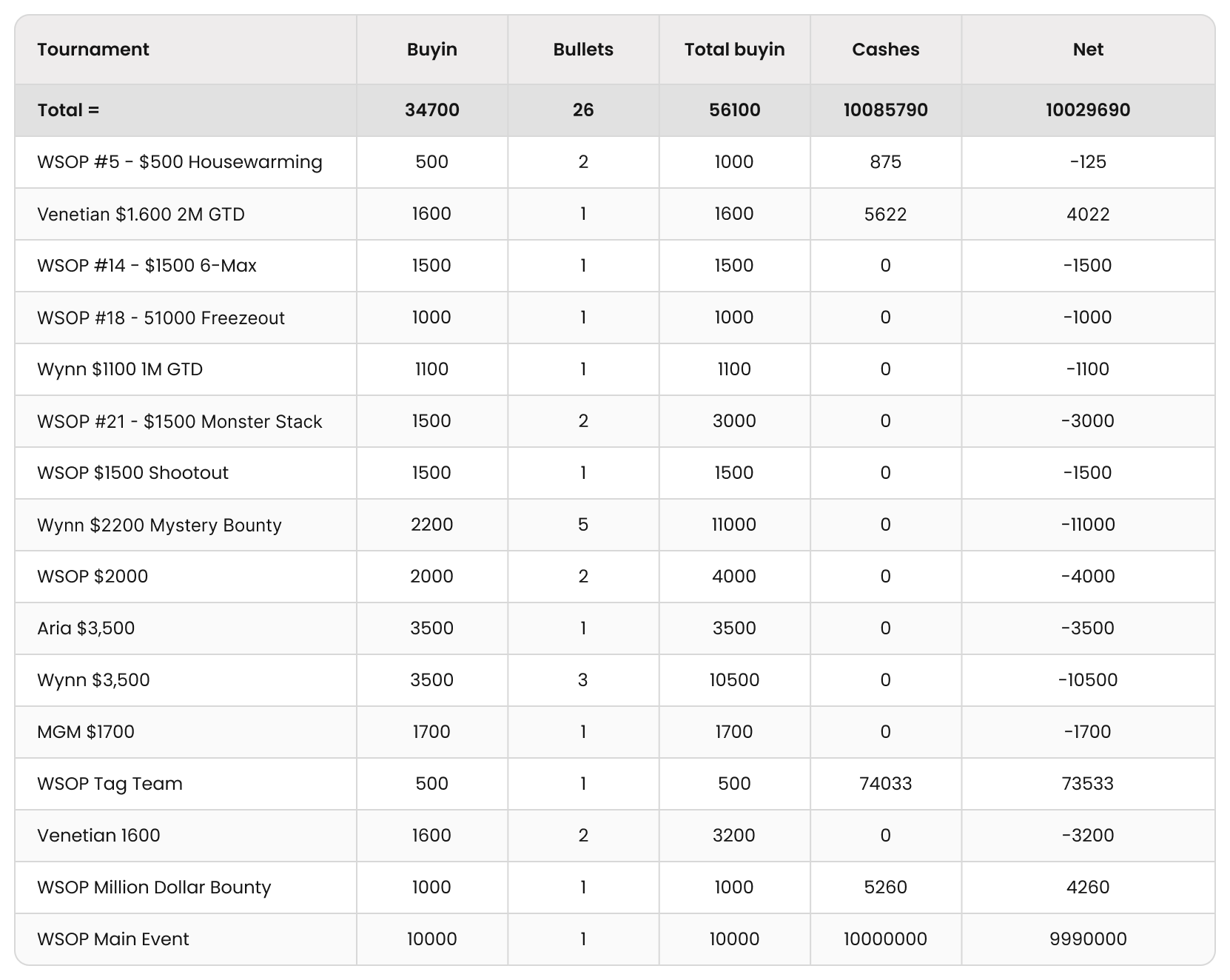

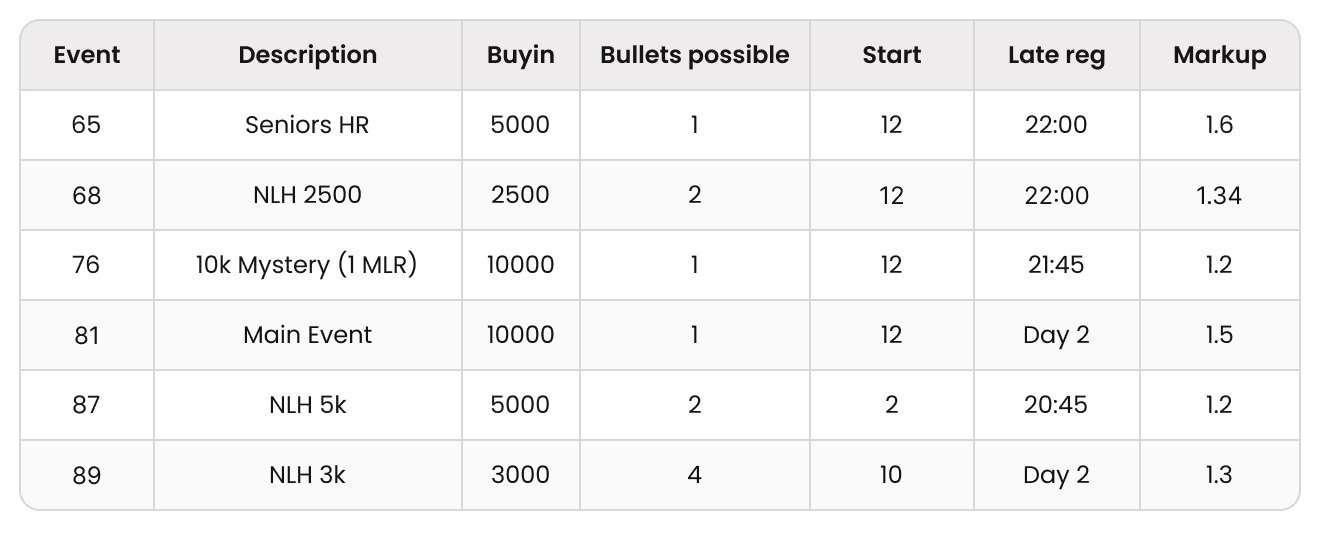

This, for example, is a staking package for the WSOP that I have bought a piece of this year:

As you can see, the Main Event is at 1.5, and the Seniors High Roller is at 1.6, both events full of recreational players. The $5,000 event, however, will have a higher concentration of tough regulars. Therefore, the markup is set to only 1.2.

Some argue that matching the markup with the horse’s ROI is not fair to the backer, who should also benefit from the ROI. Shaun Deeb, the self-confessed ‘Markup Police’, has strongly argued that a horse should split its ROI with a backer. So, for example, if they agree the horse has a 40% ROI in a tournament, they should sell at 1.2 (not 1.4), meaning both parties get half of that EV (= 20%).

Poker players argue about markup perhaps more than any other topic because it gets us into the debate of whether a poker player is profitable at all. One thing is clear about markup, however, and that is that the vast majority of poker players overestimate their profitability when they set their markup.

There is also a debate about the ethics of markup. Is it unethical, for example, for a player to charge overly high markup?

If that player is potentially unprofitable, should they be called out for egregious markup? Or should we respect the free market if a backer is happy to buy at that price? That’s a debate for another time, one which you will see happen a lot every year at the WSOP.

Staking Issues

Breach of Contract by Horse

The biggest one is simply the horse not paying the backer. A player in $200,000 makeup has a $100,000 score and decides to keep all of it. Sadly, the victims only learn the important lessons about only dealing with players they can trust too late. In some cases, they have a contract and try to enforce it in courts, but these instances are few and far between, and unfortunately, most governments stay out of gambling disputes.

Breach of Contract by Backer

There is also the issue of a backer asking to buy a piece, but not sending the money to the horse before the event starts (or sending the money only when it is clear that the horse is going to go deep). A related issue is starting up negotiations but not finalizing them in time, or simply one party claiming the counterparty agreed to buy a piece but never formally recording it in some way.

A strict policy of backing only be valid after funds have been received and making sure the agreed-upon terms are written down somewhere, including the word ‘BOOKED’ to signify a done deal, will usually prevent this issue.

Fraud by Horse

Another issue for backers is when a player lies about their ability to secure staking. Like the issue of non-payment above, this is a case of “caveat emptor” (buyer beware), and the antidote is to do proper research before staking anyone. Most stables ask for a lot of evidence that supports the case of the player seeking staking that they’re profitable, such as SharkScope graphs, as well as quizzing them on poker, putting them on a probationary period, and (perhaps most importantly) getting references from reliable sources on both their ability and trustworthiness.

Overselling by Horse

This is when a horse sells more than 100% of their action, so they can guarantee themselves a profit even before they play, but if they win any money, they would owe more than they won. This happens when somebody sells to multiple people. Clearly, these people have no intention of paying back any future winnings in the first place when they seek out backing.

A softer, more pernicious version of this can be when somebody sells a high percentage of themselves at a very high markup. Let’s say they sell 70% of a $1,000 MTT at 1.6. They have collected $1,120, locking in a $120 profit before they play. They are still playing for 30% of themselves, they have not oversold, but there comes a point where they are playing for such a small percentage of themselves that they may not be motivated enough to play their A-Game.

Negligence of Tax Implications by Horse

Not understanding or being clear about tax laws is a massive issue when somebody has a big score. Some countries pay zero tax on gambling and have a tax treaty with the USA. For example, British players keep 100% of their winnings from Vegas. Some players have hefty tax burdens from their countries. This is what the 2023 WSOP Main Event final tablists won and also likely paid in tax:

As you can see, Jan-Peter Jachmann took home more than Adam Walton, who finished above him. Because Jachmann was not a professional player and resided in Germany, that means he doesn’t get taxed on gambling winnings. If you had the choice, in this instance, you would have preferred to stake the 4th place finisher than the 3rd place finisher, if the agreement was that the backer gets the after-tax profits.

In other cases, the player does not understand the tax rules of a country they visited and only finds out about them when they are left with a bill after a big win (and after they paid out their backers). A very well-known high roller had a big result in Barcelona, paid out his backers, and then received a massive tax bill several years later. He and his backers had already spent their winnings, but legally, it was only he who had the tax burden.

Players with tax burdens should state it ahead of any deals, in particular, whether winnings will be paid to backers before or after tax.

Not Addressing Incidental Value

Who gets any additional perks from promotions is another issue that only comes up when it is too late. If you win a WSOP bracelet, for example, you get a free seat in next year’s Tournament of Champions (ToC). If you win a WPT Main Event, you get an invite to participate in the WPT World Championship for free. In the case of the ToC, the freeroll comes out of the WSOP marketing budget. In the case of the WPT, the seat comes out of the prize pool. Should the backer get a piece of those tournaments, given their stake helped the horse win them? It’s not clear-cut. For long-term backers, there is also an expectation of rakeback being split.

Not Addressing Incidental Costs

As well as perks, what about costs? Should a horse be allowed to take a percentage of their travel expenses out of their backer’s profit? I once heard of a case where a player justified a massage as an expense in this regard. This is usually a more clear-cut no, and the initial markup should reflect expenses during the event.

Whether it is promotional perks or expenses, most staking issues of this type are avoided by stating the stipulations ahead of time. In fact, most staking controversies that were not clear fraud or theft would have been prevented with due diligence.

Organized Cheating

Speaking of scandals, perhaps the biggest potential issue with staking—one that is becoming ever-present—is cheating within stables. Of course, not all stables engage in cheating, but a lot of cheating that happens in poker does occur within stables. Poker stables have been caught sharing hand histories, data mining, colluding with each other, and having coaches take over their accounts at final tables.

The issue is pronounced enough that GGPoker recently announced increased restrictions for any player who’s part of a poker stable. This was, perhaps, an effort to get more people to use their in-house staking client instead, which is not a bad thing because it prevents a lot of issues like non-payment we have mentioned today. Either way, it points to a broader industry effort against poker stables. I personally am agnostic about poker stables, but if you are on the fence about them, it might be in your interest to avoid them simply because it seems inevitable that a clampdown is coming.

Conclusion

The paradox of staking is that only winning players can get it, which leads one to ponder why they need it.

There are lots of reasons to get staked in poker, depending on your circumstances. Staking is a way to:

- Reduce variance

- Reduce financial pressure

- Take shots at lucrative games

- Fasttrack playing at higher stakes

- Improve from coaching

- Or simply to impose structure into your life

Staking sounds like the dream for a lot of players, but as is the case whenever large sums of money change hands between two parties, they can be rife with issues. Most of those issues are either trust issues—about whether one party is not going to honor their side of the contract—or transparency issues where an unexpected hiccup was not addressed before the deal was agreed.

Makeup Deal

There are also significant mental game issues that can arise with staking, most notably when a player is deep in makeup. Too often, players are moved up the stakes too quickly and then put into an amount of makeup that looks impossible to clear. The prospect of needing multiple big scores to get out of red can be demotivating for a lot of players, and it often leads them to quit the game.

Markup Deal

Markup deals, by comparison, are much more horse-friendly because there are no obligations beyond the target event(s). They do require you to justify your markup and your ROI, but that is something all staking deals will likely include. Again, the paradox of staking is proving that you are already a winning player.

The BB’s incentives for calling an SB preflop raise differ from those of a cold-caller facing a raise from, say, LJ or CO. And the SB’s incentives for raising differ from those of an open-raiser in any other position.

Author

Barry Carter

Barry Carter has been a poker writer for 16 years. He is the co-author of six poker books, including The Mental Game of Poker, Endgame Poker Strategy: The ICM Book, and GTO Poker Simplified.

Wizards, you don’t want to miss out on ‘Daily Dose of GTO,’ it’s the most valuable freeroll of the year!

We Are Hiring

We are looking for remarkable individuals to join us in our quest to build the next-generation poker training ecosystem. If you are passionate, dedicated, and driven to excel, we want to hear from you. Join us in redefining how poker is being studied.