Poker Insurance: Reducing Variance or Wasting Money?

Variance is what makes poker great. Without it, recreational players would not keep playing. Most players say they understand this, yet frequently try to avoid or reduce variance at the tables, even when what they are doing is profitable. The best example of this might be the many ways in which poker players can “insure” themselves against bad luck.

What follows is an overview of some of the popular forms of insurance in poker.

Run It Twice

We will start with the most well-known and popular, as well as the most fun, way to mitigate risk at the table. Running it twice (or three, or four times). This can occur in cash games when two players get all their chips in the middle of the table, then agree to deal two/three/four boards or board runouts.

The flop is T♥J♥2♦, player 1 has A♥K♥ and player 2 has Q♣Q♠.

They go all-in and agree to run it twice.

In the first run, the turn comes 4♥ and the river comes 3♣. Player 1 wins with their nut flush.

In the second run, the turn comes 9♠ and the river comes 4♦. Player 2 has held this time.

Both players having won once results in the pot being split 50/50.

The Math of Running It Twice

Unlike the other forms of insurance that will follow, there is no house edge when you run it twice. In fact, neither player’s expected value (EV) changes, despite what some people think.

Let’s go back to the above example to illustrate this.

Player 1 with A♥K♥ has 56.06% equity on the T♥J♥2♦ flop.

Player 2 with Q♣Q♠ has 43.94% equity.

If the two players run it twice, player 1 will:

- Win both pots 31.43% of the time

- Win one pot and lose the other pot 49.26% of the time

- Lose both pots 19.31% of the time

Suppose the pot is $100. If they only ran it once, player 1 would win the first pot 56.06% of the time. Their expected value would be $56.06.

56.06% x $100 = $56.06

If they run it twice, player 1 wins $100, 31.43% of the time and $50, 49.26% of the time.

(31.43% x $100) + (49.26% x $50) = $56.06

The expected value is the same, regardless of how many times you run it. It’s your odds that change between runouts because cards have been dealt in the first runout that can’t come in the second. For example, if two hearts show up in the first run, the probability of A♥K♥ winning the second runout reduces significantly. But at the point the decision to run it twice is made, before the runouts are dealt, your EV is the same as if you don’t run it multiple times.

The upside of running it twice is that you reduce negative variance. The downside is that you increase your chances of not scooping the whole pot when you are the favorite, thereby reducing positive variance.

Worth mentioning is that the operator usually does not take an extra fee for additional runs. But if they do, extra runs should be avoided.

The Psychology of Running It Twice

There are other aspects to be mindful of when considering to run it twice or not. Most notably, recreational players get extra enjoyment out of it because it feels like an additional gamble. Plus, a lot of them learned about it via TV shows like High Stakes Poker where they watched their hero or villain negotiate how many times to run it. So, one positive for running it twice is you keep the players you make the most money from happier, which should translate to them playing more often.

Another consideration is that if you have a reputation for never running it twice, your opponents may be reluctant to get their stack in against you because they don’t have the comforting idea of being able to run it twice. This is bad when you have a very strong hand but good when you are bluffing.

EV Cashout

A more direct form of insurance when a player is all-in is “EV Cashout.” Operators offer a service where a player who gets their money in as the favorite can take their equity before the remaining cards are dealt, usually for a fee.

You are playing 50NL and managed to get your money in the middle for a $100 pot with 65% equity.

There’s the option to take $65 right now, minus a 1% fee.

You pay a small fee but get to realize most of the value of your hand risk-free. The hand will still play out for the benefit of the other player. If your hand would have held, the difference between the final pot and what you cashed out is removed from the table. If your hand would have lost, there are more chips on the table because your opponent has the pot and you have the EV cashout.

Over the long term, this is a terrible deal. The fee is 1% at GGPoker and 2% at PokerStars. Compounded over time, this is a massive drain on your bankroll. Just imagine how costly a 2% rake increase would be over time, the impact is similar.

In the short term, it might be a viable option for somebody with tilt issues or a player taking shots at a higher stake. These are both short-term incentives where the benefits and drawbacks of variance might compound.

- Benefit – Several successful shots at a higher stake might set you up to become a regular in those games.

- Drawback – A tilt issue might impact not just your play in the session but also your motivation to play in future sessions.

So paying a small fee to ensure a smoother experience might be in your near-term interest.

Bubble Insurance

The worst feeling in poker is bubbling a big tournament, which is why it makes sense that the tournament version of insurance revolves around this event. The worse the feeling, the more demand for protection against it.

There are three forms of bubble insurance in tournaments:

- Third-party services whom you pay to insure you on the bubble

- Early bird incentives from operators to protect you on the bubble

- Deals between the players to “save” the bubble boy/girl.

1) Third-Party Bubble Insurance

This is not much of a thing anymore, but in the mid-2010s, several websites offered bubble insurance as a service. You would pay them a small percentage of the buy-in, and they would pay you out your buy-in if you finished in one of the immediate places before the money. I suspect these services never took off because they were not regulated and there were contractual disputes that made them unviable.

You do see people offer it ad hoc in casinos. The first time I ever witnessed it was in a £1,000 GUKPT Main Event and it was my first introduction to UK poker legend Neil Channing. We were on the bubble with 28 players and the min-cash was £1,700. Channing was walking up and down the tables offering bubble insurance where you paid him £200 and if you bubbled he would pay you your £1,000 entry fee back.

It was essentially a 4/1 bet that you would not bust.

I played around with an ICM calculator years later to mock up the tournament in question, with a number of varying stack sizes, and roughly speaking the short stacks were all worth about £3000. I’d suggest that only an incredibly short-stacked player would find it worth their while.

From Channing’s perspective, he only needed six people to take him up on his offer to guarantee a profit, as only one player can bubble. In reality, it was likely even more profitable than that as the kind of people who purchased bubble insurance were also likely the types who would hold on for dear life to secure the min-cash.

2) Bubble Protection

A recent innovation by GGPoker is bubble protection:

Any player who is registered at the start of a tournament gets an incentive in the form of their buy-in returned if they bust out near the bubble.

The motivation is to get people to start registering on time. The more people who enter early, the bigger the prize pool and the more likely they are to make the guarantee. More players at the start means more will re-enter too. It also combats the more recent trend to register as late as possible, which is bad for operators with big guarantees, more on that in a moment.

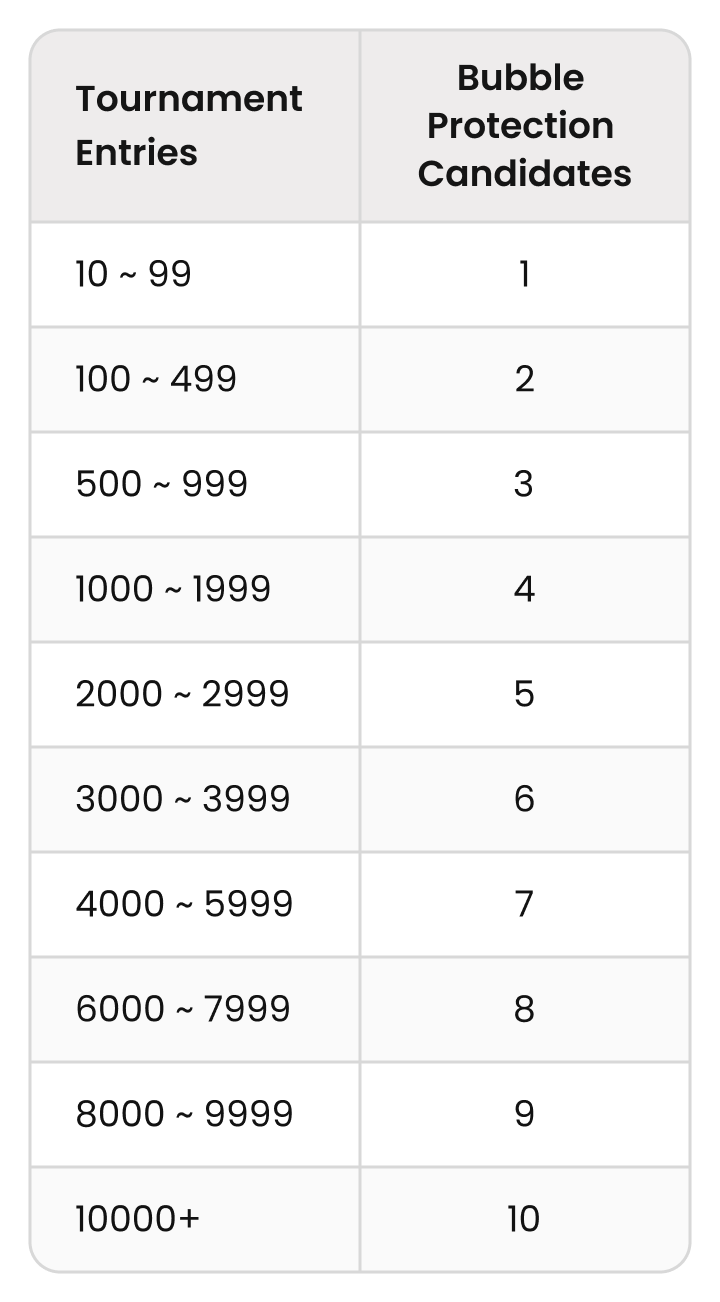

This is the number of positions that have bubble protection:

So, in a 50-runner MTT that pays out 9 places, the 10th place finisher would get their buy-in back. In a 1,000-runner MTT that pays out 150 places, the 151st–154th finishers would get their buy-in back. However, if the 151st–154th finishers did not register at the start, they got nothing.

The value of bubble protection is essentially like added money in the prize pool, but only for those who registered at the start. In a $10 MTT with 1,000 (pre-registered) runners, if you have bubble protection, it is like an extra $40 (4 x $10 buy-ins) has been added to the prize pool. For a player with bubble protection, their $10 buy-in becomes worth $10.04. Nothing to get excited about.

Now, if a $10 MTT had 10 runners and paid 3 players, 4th place would get $10. The equity boost for the bubble protection players would see their $10 become worth $11. However, this is a moot point because most GGPoker MTTs attract hundreds, if not thousands, of players.

Therefore, the equity boost from pre-registration is minimal and, of course, conditional on you being one of the players who registered at the start of the tournament. You get a much greater equity boost most of the time by late registering for the tournament, as we have explored in detail before in our article on late registration. The one exception is the knockout format, where you should register from the start to maximize the number of bounties you can win. In this respect, getting a small equity boost from bubble protection makes it worth being an early bird.

Virtual Bubble < Official Bubble

There is one other consideration with bubble protection, and that is when you arrive on the official money bubble itself. If you registered at the start, when the bubble takes place, it has essentially ended for you but not for the other players who didn’t pre-reg. You also do not know which other players have bubble protection. This also means that your virtual bubble takes place a few places earlier than it does for the other players. There is no perfect way to solve for this, but it is an opportunity to play more aggressively than usual because your true bubble factor will be much lower than it appears.

3) Saver deals

A saver deal occurs on the money bubble of live tournaments and it is similar to a final table deal, but with multiple tables agreeing to it. What tends to happen is either one buy-in or an extra min-cash is taken from 1st place and given to the bubble position. All it really does is make the actual bubble one position earlier. Everyone in the tournament has to agree to it, so they usually get rejected in large field MTTs.

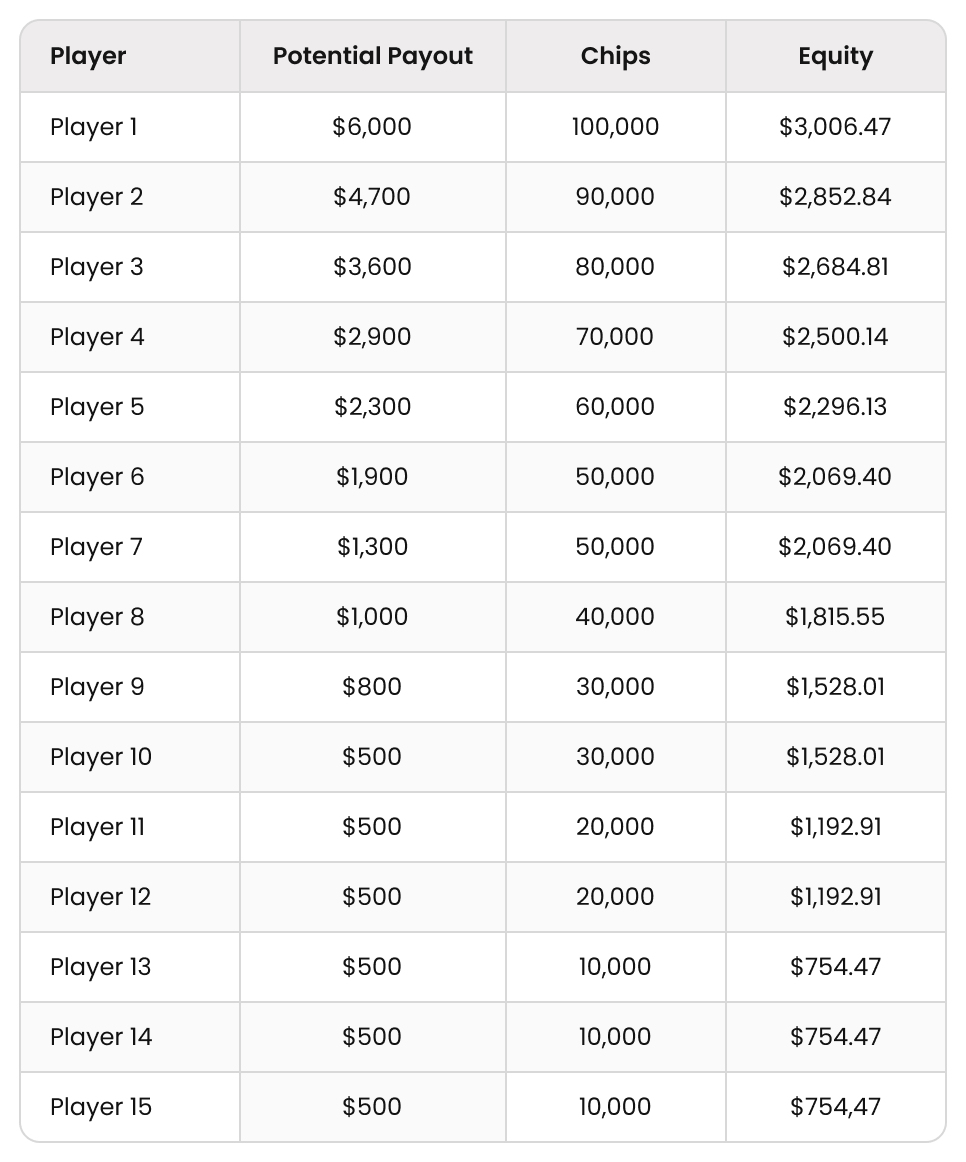

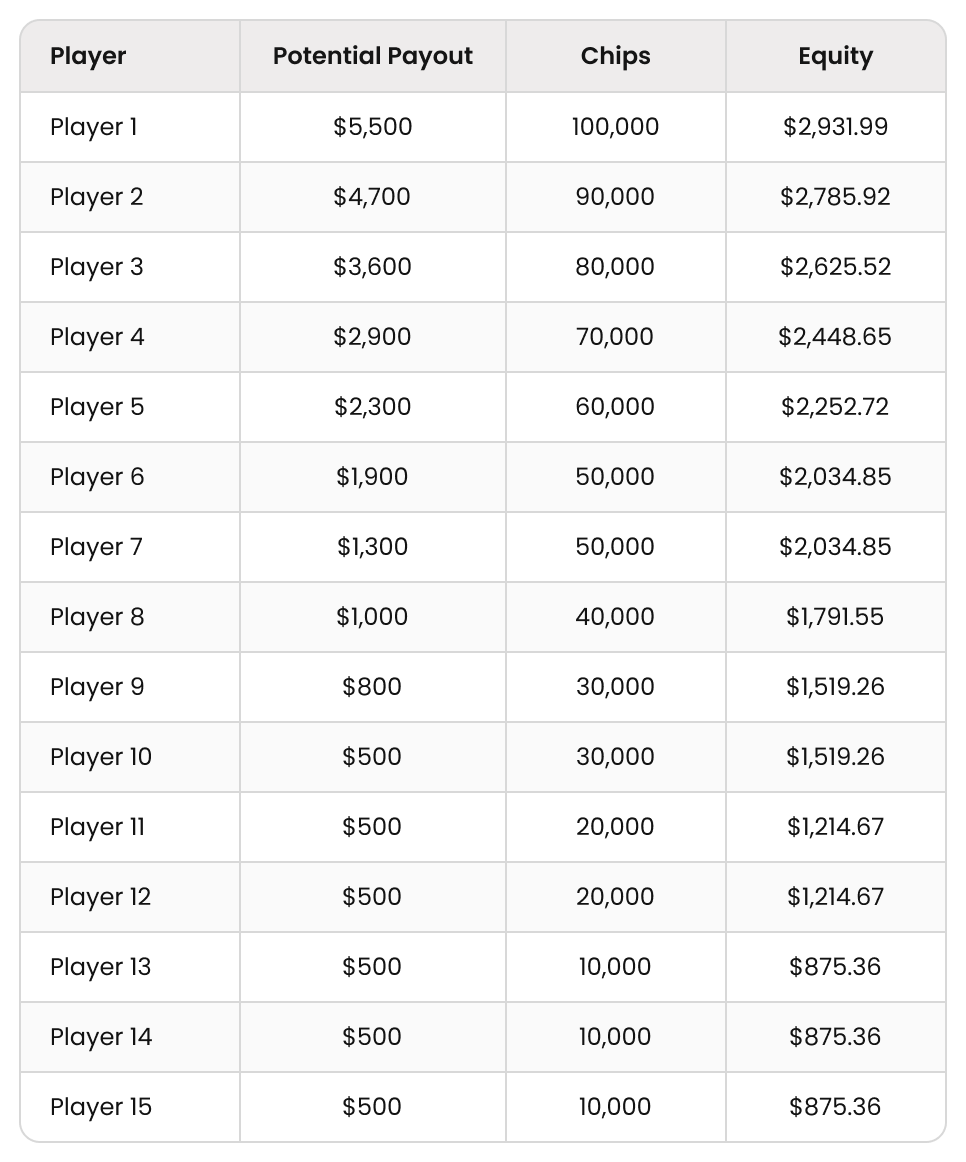

Let’s look at an example. This is a $200 MTT with 15 players left, and we are on the bubble. The state of the tournament is as follows in terms of the chip counts, equities, and the payouts if each player maintains their position:

Now, let’s observe what happens when we take $500 from the top so we can give the official bubble position a min-cash too:

- The short stacks have all seen an equity boost and also got to realize $500 in equity.

- The big and middle stacks (not just the chip leader) have all seen a reduction in their equity.

- The chip leader loses $74.78 in equity.

- Player 2 loses $66.92, with each player after them losing a lower amount.

The two arguments usually made for saver deals are that they speed the game up, and also, it’s just not cool to bubble. Big to medium stacks should reject both of those arguments. The bubble is where skilled tournament players make their EV and the longer they go on the better. Short stacks, however, should usually accept a saver deal because as we have seen, most of their tournament equity is in the min-cash.

Multiplier Insurance

Another recent innovation in poker, more specifically in the world of lottery SNGs, comes yet again from the minds at GGPoker. Spin & Gold insurance hedges against getting the lowest multiplier.

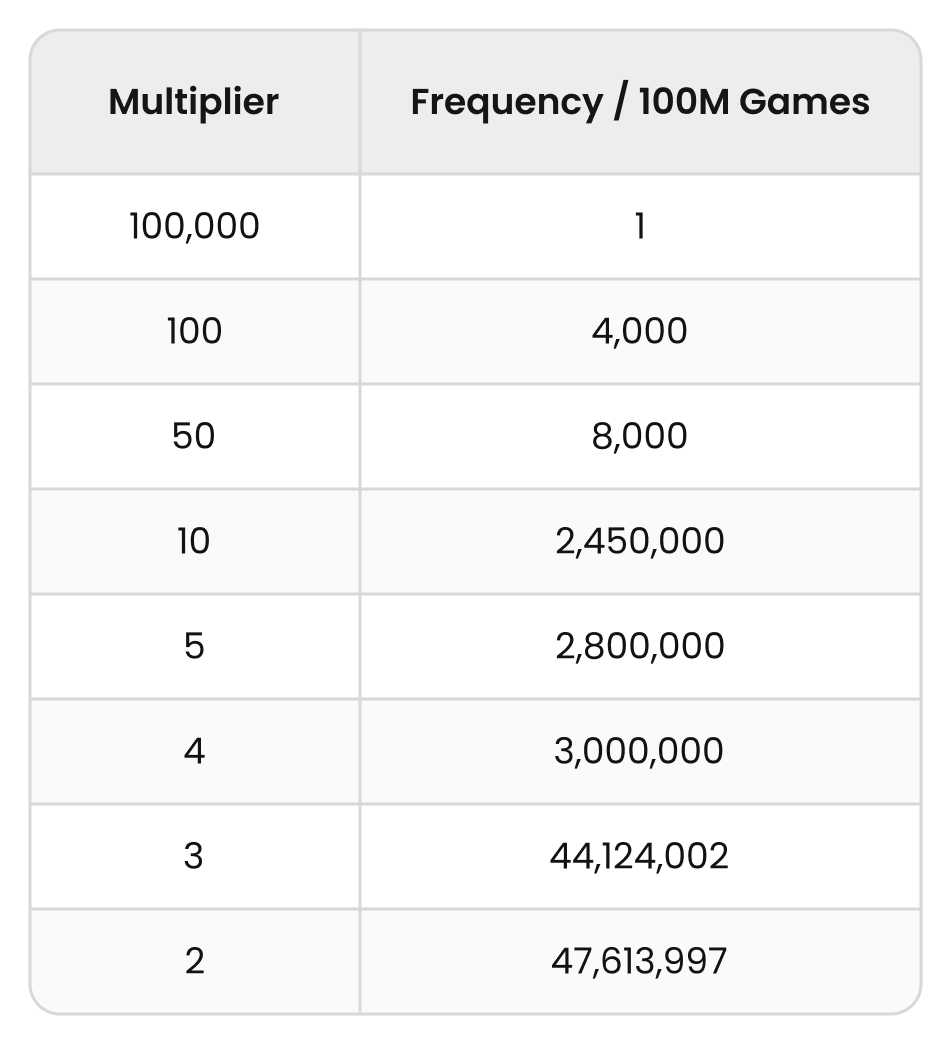

For example, these are the potential multipliers in a $10 Spin & Gold game and how frequently they occur:

The x2 multiplier happens just under half the time. You can, however, purchase insurance for another $10. If you are then drawn in a min-multiplier game, you are refunded both your $10 buy-in and your $10 insurance payment and left to freeroll in the x2 game. If drawn in a x3 game, it costs you $20 (rather than $10) to play for a $30 prize, and so on.

The odds of being drawn in a min-multiplier game are 47.61%, so as mentioned earlier, it happens just under half the time. If it happened 50% of the time, multiplier insurance would be a breakeven proposition, but because it happens 47.61% of the time, the house edge is 2.39%.

Certainly not a good deal. Unlike the other forms of insurance in poker, this is not something that protects you from the pain of losing when you were the favorite to make a profit. This is actually insurance that protects you from the boredom or disappointment of playing in a low multiplier game. Which is a very real mental game issue for lottery SNG players.

A professional Spin & Go player once told me the bulk of his EV came from gamblers who punt right away in x2 spins because they want to move on to the next game for a second chance at spinning the wheel for a big multiplier. This mindset issue is even reflected in the blind structure, with most lottery SNGs setting up fast-paced hyper structures for their x2 games and slower structures for their big multipliers, in recognition of the consensus that hardly anybody likes playing the x2 games. Serious Spin & Gold grinders should avoid multiplier insurance.

Conclusion

On a long enough timeframe, all of the above insurance options that have a house edge built-in are a bad deal. Assuming a sturdy mental game, poker players who never indulge in insurance offers will be better off, long term, than those who do make use of them. The same is true of insurance in general. Think about it: if insurance was profitable for the customer, the companies offering it would go out of business. For example, everyone who has car insurance would, in theory, be better off without it and instead put the insurance premiums in an investment account to draw from if they had an unforeseen car accident.

In some cases, insurance is mandated by the government. But even when it isn’t, we buy it nevertheless. When I buy a new car, I always purchase “gap insurance,” which is additional insurance to cover the difference between the purchase price of a car and the depreciation of that amount the second you drive it away from the car showroom. Going into it, I know it is an absolutely terrible policy that is a complete waste of money for most people. I also know how gutted I would be to crash a new car and not be able to replace it with an identical car.

That is what insurance really is: peace of mind. Insurance is never worth it from an expected value perspective, but it is often worth paying to reduce anxiety.

Buying insurance at the poker table will cost you over the long term. Whether it’s worth it is a question of whether the worst-case scenario of not taking it would cost you more. EV cashout, for instance, costs you 1% each time, but if that means you don’t go on tilt and spew much more than that, then it’s a bargain. It might also mean you can take a shot at a higher stake with less stress. If you are playing in a much bigger game than usual, insurance has the same benefit as a final table deal. It’s about reducing variance in big spots that don’t come around very often.

Insurance at the poker table exists because humans are not well-wired to understand or deal with variance. However, variance in poker is a feature, not a bug. If tilt is an issue to the point where you need to buy insurance, then the priority should be working on your mental game so that you don’t need it (while using insurance in the short term to not exacerbate the problem). Over the course of a career, that extra few percent you save from not taking insurance will compound into something significant.

The BB’s incentives for calling an SB preflop raise differ from those of a cold-caller facing a raise from, say, LJ or CO. And the SB’s incentives for raising differ from those of an open-raiser in any other position.

Author

Barry Carter

Barry Carter has been a poker writer for 16 years. He is the co-author of six poker books, including The Mental Game of Poker, Endgame Poker Strategy: The ICM Book, and GTO Poker Simplified.

Wizards, you don’t want to miss out on ‘Daily Dose of GTO,’ it’s the most valuable freeroll of the year!

We Are Hiring

We are looking for remarkable individuals to join us in our quest to build the next-generation poker training ecosystem. If you are passionate, dedicated, and driven to excel, we want to hear from you. Join us in redefining how poker is being studied.